Many people, you know, find themselves curious about the financial standing of public figures, and that's just a natural thing, really. It's almost like we want to understand how success is measured in different ways, or what kind of resources someone might have gathered over time. This interest often leads folks to look up things like "Cameron Colvin net worth," trying to piece together a picture of someone's financial journey.

When you think about it, understanding someone's net worth isn't just about a single number; it's a bit more complex than that. It involves looking at what they own, what they owe, and how their career and choices have played out financially. It's a way, perhaps, to see the outcomes of various decisions and opportunities, which can be pretty interesting to consider, in a way.

While our source text talks a lot about smart shopping, finding discounts at places like Best Buy and Lowe's, and the educational offerings at Cameron University, it doesn't actually provide specific financial details or a net worth figure for Cameron Colvin. So, this article will explore the general ideas behind net worth, what factors usually influence it, and why people are often so keen to know about these figures, you know, for public individuals.

Table of Contents

- Understanding Cameron Colvin: A Glimpse into Background

- What Does "Net Worth" Really Mean?

- Building Financial Standing: Lessons from Everyday Savvy

- Factors That Influence a Public Figure's Net Worth

- Common Questions About Net Worth

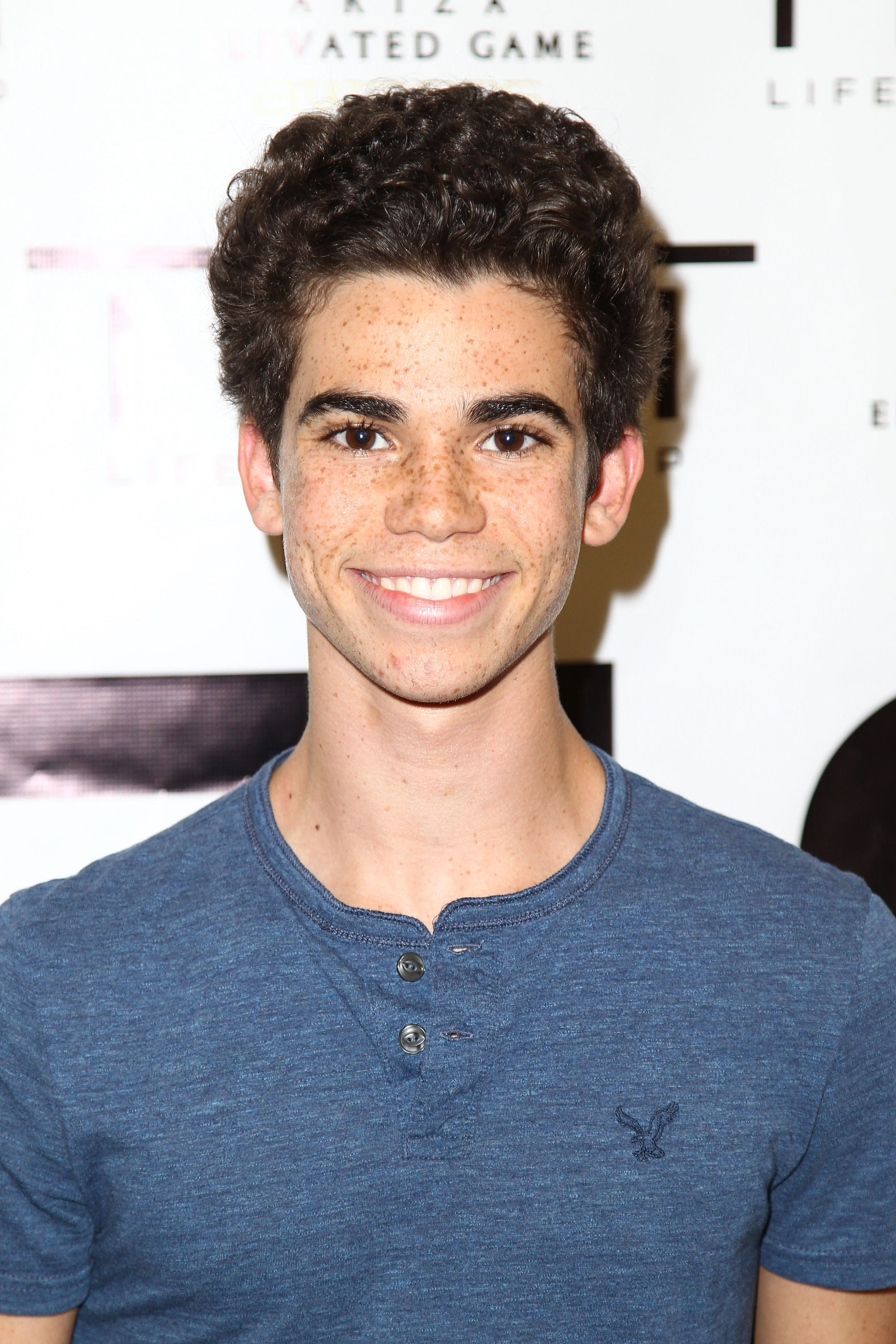

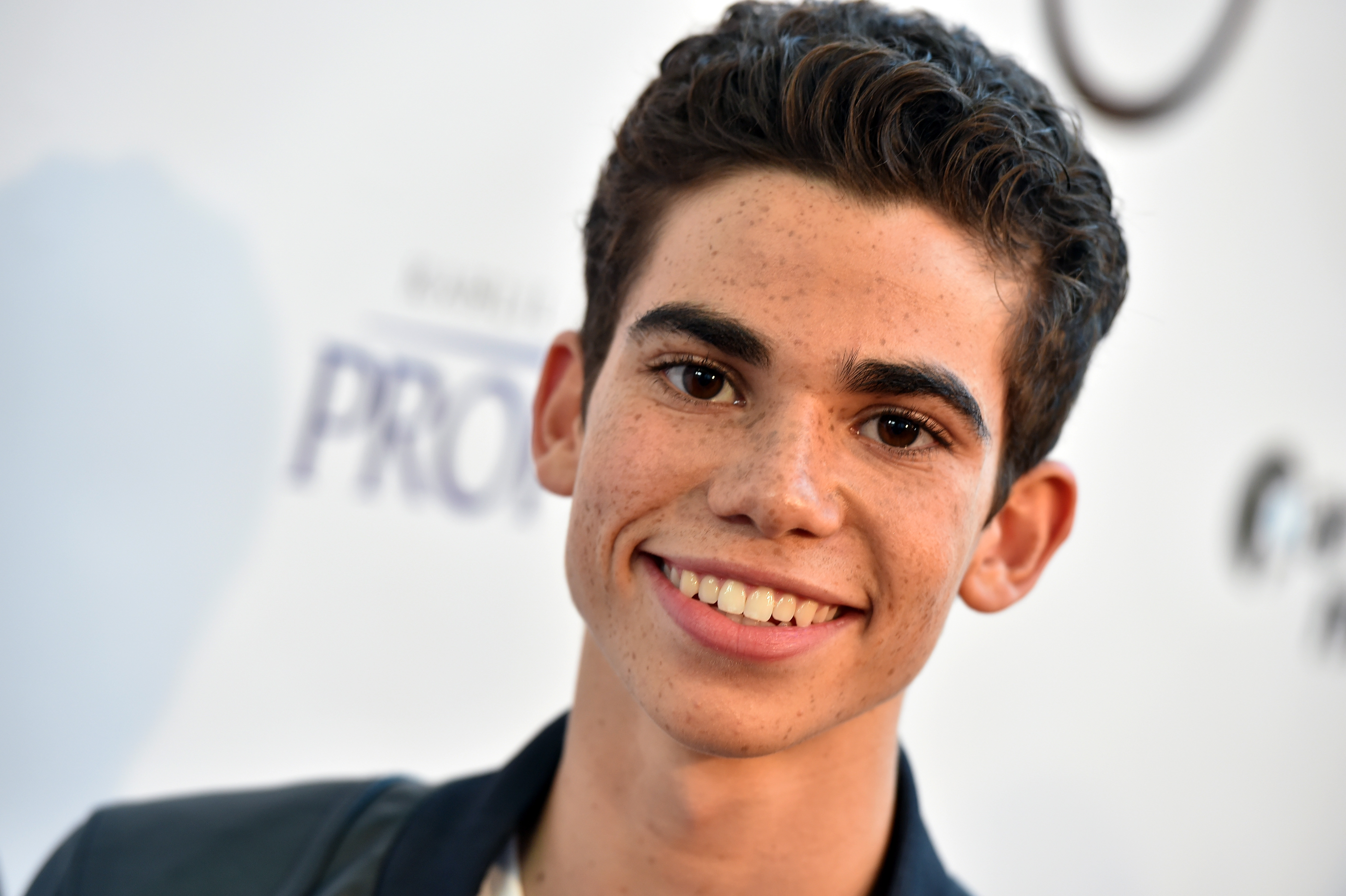

Understanding Cameron Colvin: A Glimpse into Background

When we talk about someone like Cameron Colvin, people often want to know a bit about their life story, don't they? This helps put their financial situation into some kind of context. It's really about seeing the path they've walked, what they've achieved, and how those things might connect to their financial picture. Our provided text, interestingly enough, talks a lot about Cameron University, its academic programs, and student services, which is quite different from personal biographies.

So, while the text gives us a good look at how Cameron University supports its students with things like AggieAccess for grades and schedules, or the McMahon Library for learning needs, it doesn't share any specific details about an individual named Cameron Colvin. This means we can't draw direct connections from the text to his personal background or career path. It's just not there, you know?

Typically, when you're trying to understand someone's net worth, you'd look at their career choices, any major projects they've been involved with, or perhaps their public contributions. These elements often play a big part in shaping someone's financial standing over time. For now, we'll focus on the general principles that apply to anyone's financial journey, which is actually pretty useful, too.

Personal Details and Bio Data

| Category | Details for Cameron Colvin (Based on provided text) |

|---|---|

| Full Name | Information not available in the provided text. |

| Date of Birth | Information not available in the provided text. |

| Place of Birth | Information not available in the provided text. |

| Occupation/Profession | Information not available in the provided text. |

| Known For | Information not available in the provided text. |

| Education | Information not available in the provided text. (Our text mentions Cameron University offers degrees, but not specific to Cameron Colvin.) |

| Key Achievements | Information not available in the provided text. |

What Does "Net Worth" Really Mean?

So, what exactly is net worth? It's a pretty straightforward idea, really, even though it sounds a bit formal. Basically, it's a way to measure a person's financial health at a particular moment. You just add up everything they own, and then you subtract everything they owe. The number you're left with is their net worth. It's like taking a snapshot of their financial situation, you know?

This figure can change quite a bit over time, too. Things like investments going up or down, or taking on a new loan, can make that number move around. It's not a fixed thing, by any means. It's more of a dynamic picture, always shifting with life's events and financial decisions. That's just how it is, actually.

Understanding net worth is pretty useful for anyone, not just public figures. It helps individuals get a clear idea of where they stand financially. For businesses, it's a similar concept, showing the value of the company. It's a fundamental part of financial literacy, something our source text touches on in a way, with all its tips about smart shopping and saving money.

Assets and Liabilities: The Core Calculation

To get to that net worth number, you've got to look at two main things: assets and liabilities. Assets are everything a person owns that has value. This could be their home, cars, money in savings accounts, stocks, bonds, or even valuable collections like art or jewelry. It's basically anything that could be turned into cash, or that holds value, you know?

On the other side, you have liabilities. These are all the things a person owes. Common liabilities include mortgages on a house, car loans, student loans, credit card debt, or any other money borrowed. It's the financial obligations that need to be paid back. So, you take all those valuable things, and you subtract all those debts, and that's your net worth. It's a simple formula, really.

For example, if someone owns a house worth $300,000, has $50,000 in savings, and a car worth $20,000, their total assets would be $370,000. If they owe $200,000 on their mortgage and $10,000 on a car loan, their total liabilities are $210,000. Their net worth, in this case, would be $160,000. It's a straightforward calculation, basically, that gives a pretty clear picture.

Why People Look at Net Worth

There are many reasons why people are curious about net worth, especially for public figures. For some, it's about inspiration; they want to see what's possible, or how certain career paths can lead to financial success. It can be a way to gauge someone's impact or influence in their field, too, in some respects.

Others might look at net worth for comparison, maybe wondering how they stack up, or just out of general interest in how wealth is distributed. It's also a common topic in media, where discussions about public figures often include their financial standing. So, it's not surprising that "Cameron Colvin net worth" would be a search term people use, you know?

For fans, it might be a way to feel more connected to a person they admire, understanding another aspect of their life. For those in business, it could be a way to assess potential partners or competitors. It's a number that, for better or worse, has come to symbolize a certain level of achievement or financial security in our society, so people are naturally drawn to it, you know.

Building Financial Standing: Lessons from Everyday Savvy

While we're looking at the idea of "Cameron Colvin net worth," it's worth thinking about how anyone, really, builds their financial standing over time. Our source text, in a very practical way, gives us some great tips on managing money in daily life. Things like getting discounts at Best Buy, using Slickdeals coupons, or finding smart ways to save on things like grills. These are all small steps that, over time, can add up to a stronger financial picture, you know?

It's about making smart choices with your money, whether it's buying unclaimed Amazon packages, selling unwanted gift cards online, or knowing the best time to buy certain items. These everyday financial habits, you know, are the building blocks of personal wealth. They show that even seemingly small decisions about spending and saving can have a big impact on your overall financial health. It's pretty clear, actually.

The text also mentions how an annual membership fee for a shopping service can quickly become "worth it" for most folks due to the savings they pocket. This highlights the idea of value and making investments that pay off in the long run. It's a concept that applies to everything from daily purchases to major financial decisions, which is actually pretty important.

Smart Spending and Saving: A Foundation for Growth

One of the clearest messages from our source text is the importance of smart spending. It talks about "hacking the system" at Best Buy to get discounts, finding "incredible deals" on Amazon's outlet section, and using tips to "make the most of your money while shopping at Lowe's," like price matching. These aren't just about saving a few dollars; they're about being a wise consumer. That's a foundational part of building wealth, you know?

Saving money on purchases means you have more money left over for other things, like investments or building up an emergency fund. It's a simple concept, but it's often overlooked. Knowing "how and when to get the best deal" on items, or how to "sell gift cards online" to put "unwanted gift cards to good use," are practical steps toward better financial management. These small actions, you know, really add up over time.

This approach to finances is pretty similar to how someone builds their net worth. It's not usually about one big windfall, but rather a consistent effort of managing income, controlling expenses, and making smart choices with resources. It’s a bit like accumulating small victories that eventually lead to a bigger win, which is something anyone can do, really.

The Role of Education and Career Paths

Our source text also talks a lot about Cameron University, detailing its degrees, majors, and academic support services. This brings up another very important factor in building financial standing: education and career choices. Getting a good education, like the master's, bachelor's, and associate degrees offered at Cameron, can open doors to better job opportunities and higher earning potential. It's a pretty big deal, actually.

The text mentions how Cameron University "values student learning as our top priority" and uses "teaching, research, scholarship, service, and mentoring to prepare students academically and professionally." This kind of preparation is often a direct path to a stable and rewarding career, which, in turn, influences one's income and ability to accumulate assets. It's a long-term investment in oneself, you know?

A strong career path, often supported by a solid educational background, is a major contributor to someone's net worth. It provides a consistent income stream that allows for saving, investing, and reducing liabilities over time. So, while our text doesn't talk about Cameron Colvin's specific education, it highlights the importance of institutions like Cameron University in shaping futures and, by extension, financial well-being. You can learn more about saving money on our site, and link to this page financial tips for more information.

Factors That Influence a Public Figure's Net Worth

When it comes to public figures like Cameron Colvin, if you were to research their net worth, you'd find that several key factors usually play a role. It's not just about a salary; there are often many different income streams and asset types involved. This makes their financial picture often more complex than that of someone with a single job. It's very much a multi-faceted thing, you know?

These factors can include everything from their primary career earnings to various investments, business ventures, and even their public image. The combination of these elements determines their overall financial standing. It's pretty interesting to see how all these pieces fit together, actually, for someone in the public eye.

The interest in "Cameron Colvin net worth" means people are curious about these specific influences. While we don't have those details from our provided text, understanding the general categories helps explain how such figures are typically estimated or calculated for anyone in the public sphere. It's a common way to assess success, you know?

Career Earnings and Professional Endeavors

For most public figures, their primary career is a huge source of income. This could be from acting, sports, music, business leadership, or any other field where they gain prominence. These earnings, which can be quite substantial, form the base of their financial assets. It's often the first thing people think about when considering someone's wealth, you know?

Beyond direct salaries or performance fees, many public figures also earn money from endorsements, sponsorships, and appearance fees. These are often tied directly to their fame and public appeal. A popular figure, for example, might sign deals with big brands, which can add significantly to their income. This is a common way for public figures to boost their earnings, actually.

Moreover, professional endeavors might include consulting roles, public speaking engagements, or even creating their own content platforms. These diverse income streams contribute to a steady flow of money, which, if managed well, can lead to a substantial accumulation of assets over time. It's a pretty varied landscape, in a way, for their earnings.

Investments and Business Ventures

Beyond their direct career earnings, many public figures wisely invest their money. This can include traditional investments like stocks, bonds, and real estate. Smart investments can grow a person's wealth significantly over time, sometimes even surpassing their direct earnings. It's a key part of long-term financial growth, you know?

Many also launch their own businesses or invest in startups. This could be anything from a clothing line, a restaurant chain, a tech company, or even a media production house. These ventures, if successful, can generate substantial profits and increase their overall net worth. It's a common path for those with capital and a public platform, really.

These business interests often diversify their income sources and provide a way to build wealth that isn't solely dependent on their primary career. It shows a strategic approach to financial management, which is pretty smart, actually. It's about making your money work for you, which is a lesson anyone can learn, you know?

Public Interest and Valuation

Interestingly, for public figures, their net worth can also be influenced by public interest and how they are valued in the media. While this doesn't directly add cash to their bank account, it affects their earning potential from endorsements, media deals, and public appearances. A higher public profile often translates to more opportunities for income. It's a bit of a cycle, you know?

The way their assets are valued can also fluctuate based on market trends and public perception. For instance, if a public figure owns a unique piece of property or a valuable collection, its market value might be influenced by their association with it. It's a subtle but significant factor in how their overall wealth is perceived and calculated, in some respects.

So, while the "Cameron Colvin net worth" figure isn't something our provided text gives us, the general principles of public interest affecting valuation are pretty clear for figures in the public eye. It's a complex interplay of personal finance and public image, which is actually quite fascinating to consider.

Common Questions About Net Worth

When people search for "Cameron Colvin net worth," they often have some basic questions about how these figures are put together. It's natural to wonder about the methods used, or what specific items are counted. These are pretty common inquiries, you know, for anyone interested in financial matters.

Understanding these common questions helps to demystify the concept of net worth a bit. It shows that while the final number might seem big or mysterious, the underlying calculations are actually pretty logical and follow standard financial principles. It's just a matter of breaking it down, really.

So, let's look at some of the questions people frequently ask when trying to understand someone's financial standing, especially for public figures. These questions are pretty universal, whether you're talking about a famous person or just someone trying to manage their own budget, you know.

How do you figure out someone's net worth?

Figuring out someone's net worth, especially a public figure's, usually involves a few steps. First, you'd try to identify all their assets. This includes real estate, investments like stocks and bonds, cash in banks, and any other valuable possessions. It's about getting a complete picture of everything they own that has monetary value, you know?

Next, you'd list all their liabilities. These are debts like mortgages, loans, and credit card balances. It's important to account for everything they owe. This part can be harder for public figures, as their debts aren't always public knowledge, so estimates often come into play, which is pretty common, actually.

Once you have both totals, you simply subtract the total liabilities from the total assets. The result is the net worth. For public figures, this often involves a lot of estimation based on public records, interviews, and market values of known assets. It's rarely an exact science unless the person publicly discloses their full financial statements. You can read more about this general process here, for example.

What makes up a person's net worth?

A person's net worth is made up of a wide range of financial components. On the asset side, it typically includes liquid assets like cash in savings and checking accounts, as well as money market accounts. Then there are investments, such as stocks, bonds

Detail Author:

- Name : Ethan Torphy I

- Username : rhianna.hauck

- Email : carrie09@schowalter.com

- Birthdate : 1984-08-03

- Address : 1603 Gutmann Plains South Werner, OK 32150

- Phone : 820-490-4783

- Company : Ledner, Glover and Wuckert

- Job : Web Developer

- Bio : Provident fuga et nam dolores eveniet. Qui saepe voluptas perspiciatis fugiat. Animi libero commodi quia. Eos autem explicabo eaque inventore sapiente minima.

Socials

tiktok:

- url : https://tiktok.com/@weldon_xx

- username : weldon_xx

- bio : Et suscipit aut consequatur magni adipisci.

- followers : 4985

- following : 843

facebook:

- url : https://facebook.com/wwilliamson

- username : wwilliamson

- bio : Rerum facilis dolore inventore mollitia voluptatem.

- followers : 6087

- following : 2638

instagram:

- url : https://instagram.com/weldon_williamson

- username : weldon_williamson

- bio : Quos deleniti dignissimos id excepturi. Eos placeat officiis ad sed.

- followers : 4423

- following : 2789

linkedin:

- url : https://linkedin.com/in/weldon.williamson

- username : weldon.williamson

- bio : Rerum est fugiat ex consectetur ut dignissimos.

- followers : 195

- following : 1801