Running a business, you know how important it is to keep money flowing smoothly. Managing cash coming in and going out, that's a big part of it, you know. When you deal with other businesses, often you agree on payment terms. One common one is "Net 30." This simply means a customer has 30 days to pay you after receiving an invoice. It sounds simple enough, but when your business goes global, things get a bit more complicated, that is. International payments can really slow things down, and they often come with extra costs you might not expect. This can make keeping track of your Net 30 payments a real headache, you see.

Imagine waiting for money from a client overseas. You sent an invoice with Net 30 terms. You expect the money in about a month. But then, bank fees pop up. Exchange rates seem to shift against you. The money takes longer to arrive than anyone thought it would, too. This kind of delay, these extra costs, they can really mess with your cash flow. They make it hard to plan your next steps, or even pay your own bills on time, you know, which is a bit of a problem.

This is where thinking about a "wise business plan net 30" comes in. It's about finding smart ways to handle those global payments. It's about making sure your money moves across borders without losing a lot of its value along the way. It is about getting paid on time, or as close to it as possible, so you can keep your business running well. We will look at how a service like Wise can really help with these kinds of payment arrangements, actually, making things much easier for your company.

Table of Contents

- What is Net 30 and Why It Matters for Your Company?

- The Usual Struggle with International Payments

- How Wise Business Makes Net 30 Easier

- Smart Ways to Use Wise for Your Net 30 Needs

- Frequently Asked Questions

- Taking Your Next Step with International Payments

What is Net 30 and Why It Matters for Your Company?

Net 30 is a very common payment term. It means that a buyer has 30 calendar days to pay an invoice. This period starts from the invoice date. It gives your customers some time to gather their funds. It is a way to build trust with clients, you know. It shows you are willing to work with their payment cycles. Many businesses use these terms, as a matter of fact, to manage their own outgoing payments too.

For your company, Net 30 terms are about cash flow. It's about when money comes into your business. If you offer Net 30, you need to know when to expect that payment. This helps you pay your own suppliers, your team, and cover your operating costs. It can be a good way to keep customers happy. It also helps you secure bigger deals, perhaps, by offering flexible payment arrangements.

Understanding Net 30 is pretty basic for business. Yet, when you add international transactions to the mix, it gets tricky. The standard 30 days can stretch out. This happens because of bank processing times. It also happens because of currency conversions. This can make your financial planning a bit harder, in a way. You need solutions that respect these terms, but also work efficiently across borders.

The Usual Struggle with International Payments

Sending or receiving money across countries has always been a bit of a challenge. Traditional banks often charge a lot for these kinds of moves. They might have high transfer fees, actually. They also tend to add a hidden markup to the exchange rate. This means the money you send, or the money you get, is worth less than you thought. It's like paying twice, you know, once for the fee and again for the exchange rate.

Bank transfers can also take a long time. Days can pass while your money moves from one country to another. This delay is a big problem for businesses. It affects your cash flow. It makes it hard to predict when funds will clear. If you are waiting on a Net 30 payment, an extra few days in transit can really throw off your schedule, you see. This is especially true if you have your own bills to pay.

Another issue is transparency. Banks are not always clear about all the costs involved. You might see one fee, but then another one pops up. This makes budgeting difficult. It is hard to know exactly how much money will arrive at its destination. This lack of clarity can be very frustrating, too, for any business trying to manage its finances carefully.

How Wise Business Makes Net 30 Easier

Wise, a company started in London by Taavet Hinrikus and Kristo Käärmann, set out to change how money moves globally. They wanted to make it fairer and faster. For businesses dealing with Net 30 terms, especially across borders, Wise offers some real benefits. It helps you manage your international payments with more control. It also helps you with more clarity, actually, than traditional banking systems.

Keeping More of Your Money

One of the biggest advantages of using Wise is the potential to save money. My text says you can save up to five times on international transfers. This is because Wise does not mark up its rates for currency exchanges. Banks, as a rule, charge a lot for overseas transfers. They often add a hidden percentage to the exchange rate. Wise gives you the real exchange rate, the one you see on Google, so. This means more of your money reaches its destination. It means more money stays in your pocket, too, which is very good for your business's bottom line.

When you are sending over 20,000 GBP or an equivalent amount, these savings really add up. Even for smaller amounts, the difference can be significant. Avoiding those hidden fees means you get a truer picture of your costs. It helps you budget better. It also helps you keep your profit margins healthier, in some respects, which is what every business wants.

Getting Money Faster and With Less Fuss

Time is money, especially for businesses. Wise helps you transfer money abroad easily and quickly. You can do it online in just a few clicks. This speed is a big deal for Net 30 payments. It means you can send invoices, and expect payments to clear closer to the 30-day mark. It helps you avoid those frustrating delays, you know, that traditional banks often cause.

While bank transfers are usually the cheapest option when funding your international money transfer with Wise, they can be a bit slower than debit or credit cards. However, even with bank transfers, Wise aims to be faster than many other options. It streamlines the whole process. This means less waiting for you. It means less waiting for your clients too, actually, which helps build good business relationships.

Handle Many Different Currencies

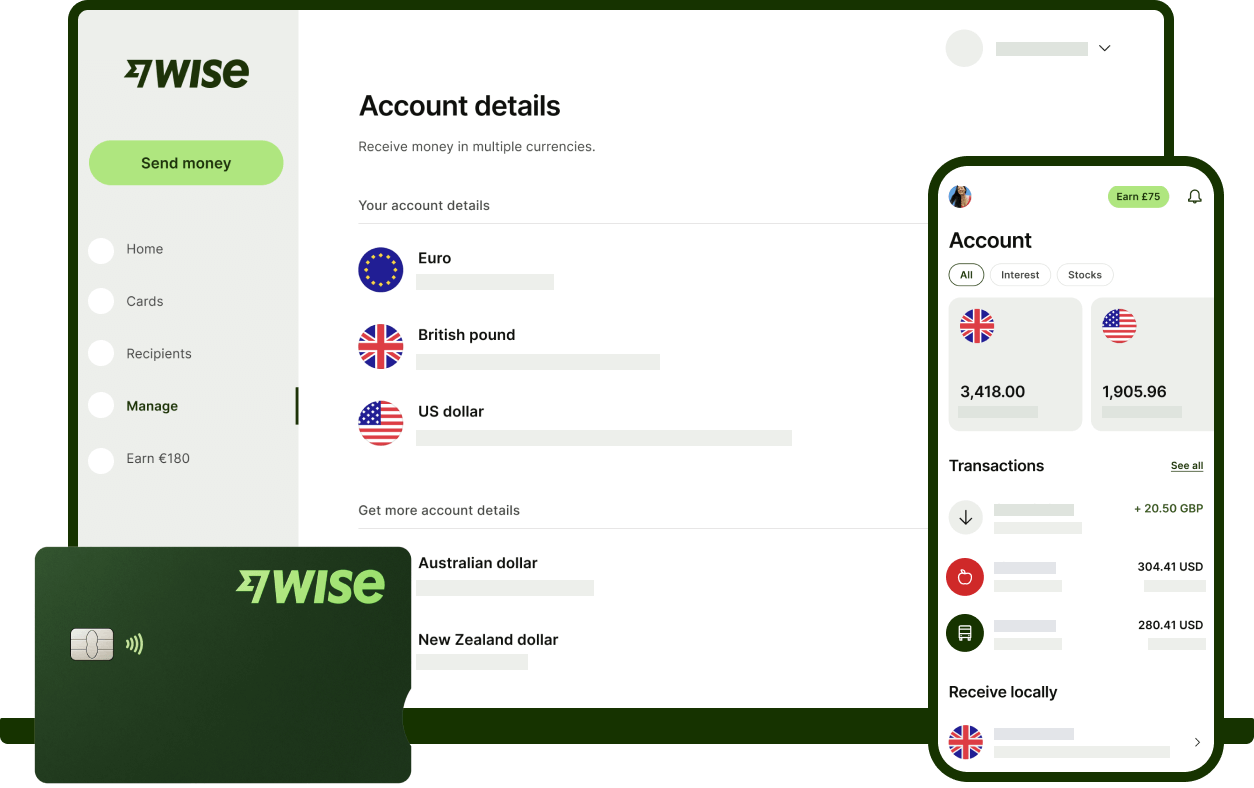

With a Wise account and Wise Business, people and businesses can hold 40 currencies. This is a huge benefit for companies dealing internationally. You can keep as many currencies as you want. This means you can get paid like a local, so. If you have a client in Europe, they can pay you in Euros. You can hold those Euros in your Wise account. You can then convert them to your home currency when the rate is good. Or you can use them to pay suppliers in Europe, too, avoiding extra conversion fees.

This ability to hold multiple currencies gives you flexibility. It helps you manage currency risk. You do not have to convert money immediately. You can wait for a better exchange rate. This feature, actually, makes managing your global finances much simpler. It helps you operate like a truly international business, no matter where your clients are located.

A Global Reach for Your Business

Wise is a global technology company. It builds the best way to move and manage the world's money. With over 14.8 million happy users, it is a widely trusted service. The company was cofounded by Taavet Hinrikus, one of the first employees of Skype, and Kristo Käärmann, a Deloitte management consultant. Hinrikus moved from Estonia to London, which really highlights the international nature of their vision, you know.

This global reach means you can connect with clients and suppliers almost anywhere. It expands your business opportunities. You are not limited by banking borders. You can send money to, and receive money from, a vast number of countries. This makes your "wise business plan net 30" truly global. It lets you chase opportunities wherever they are, actually, without being held back by financial hurdles.

Understanding Costs and Overall Value

My text mentions that Wise's services might come at a considerable cost. It says Wise charges higher transfer fees than some other options. It is important to look at this closely. While Wise does have a clear fee for each transfer, it doesn't hide extra costs in the exchange rate. Traditional banks often have lower-seeming transfer fees, but they make up for it by giving you a worse exchange rate. This hidden markup is where most of your money disappears, you know.

So, when you compare the total amount received at the other end, Wise often comes out on top. It gives you transparency. You know exactly what you are paying. You know exactly what the recipient will get. This transparent approach, actually, often means significant savings overall, especially for larger amounts or frequent international transactions, when you compare the total money received versus what you sent, which is what really matters.

Smart Ways to Use Wise for Your Net 30 Needs

Using Wise for your Net 30 payment terms can really simplify things. First, when you send an invoice to an international client, you can include your Wise account details. If you have a local currency account with Wise, for example, a Euro account for a European client, you can ask them to pay directly into that. This means they pay like a local. It avoids their bank charging them extra fees, too, which is good for your client relationships.

Second, you can set up automated payment reminders. Even if the money is coming through Wise, it helps to keep track of that 30-day window. You can easily see incoming payments in your Wise account. This helps you reconcile your books quickly. It helps you know exactly when funds have arrived, so you can manage your cash flow effectively, you know, which is very important for any business.

Third, if you need to pay suppliers on Net 30 terms, Wise can help with that too. You can send payments quickly and at a good rate. This means you meet your own payment deadlines. It helps you maintain good relationships with your suppliers. It is a win-win situation, actually, for managing both your incoming and outgoing international money flows, which is pretty neat.

Frequently Asked Questions

Many people have questions about how Wise works with common business practices. Here are a few common ones, actually, that might come up.

What is Net 30 payment term?

Net 30 means a customer has 30 days to pay an invoice. This period starts from the date the invoice is issued. It is a standard credit term. It allows businesses time to pay their bills. It also helps the invoicing business manage its expected income, you know, which is a key part of financial planning.

How does Wise Business account work for international payments?

A Wise Business account lets you send and receive money across borders. You can hold over 40 different currencies. You get local bank details for many countries. This means clients can pay you in their own currency. You can then convert it to your home currency. Or you can use it to pay others in that same currency, actually, saving on exchange fees.

Can Wise help manage cash flow for businesses?

Yes, Wise can help a lot with cash flow. It offers fast and transparent international transfers. This means you get paid quicker. You know exactly how much money will arrive. This predictability helps you plan your spending. It helps you make sure you have enough money to cover your costs, too, which is very good for business stability.

Taking Your Next Step with International Payments

Thinking about a "wise business plan net 30" means looking for better ways to handle your money across borders. It means making sure your hard-earned cash does not get eaten up by hidden fees. It means getting paid on time, or as close to it as possible, so you can keep your business moving forward. Wise offers tools that can really help with this. It gives you more control over your international finances, you know.

Considering how much banks charge for overseas transfers, exploring options like Wise makes a lot of sense. It is about making your money work worldwide, for less. You can move, send, and spend your money internationally with Wise. It helps you get paid like a local. It also lets you keep as many currencies as you need, actually, all in one place. You can learn more about Wise Business and how it can help your company.

If you are thinking about how to make your Net 30 terms work better globally, consider what Wise offers. It is a simple way to manage complex international money movements. It can help you save money and time. It helps you keep your business running smoothly, too, no matter where your clients are located. You can learn more about on our site, and link to this page for more insights on managing business payments.

Detail Author:

- Name : Kristofer Eichmann

- Username : mbailey

- Email : vbalistreri@gmail.com

- Birthdate : 1978-06-02

- Address : 5849 Labadie Union Suite 955 Mayerchester, LA 57740-5315

- Phone : +1.440.835.5890

- Company : Stehr Group

- Job : Career Counselor

- Bio : Est vel ut ipsum voluptates accusantium non voluptatem et. Officia quia aliquid atque sunt iste et esse enim. Ipsa natus repudiandae aut at. Consequatur voluptatem voluptate molestias quis.

Socials

instagram:

- url : https://instagram.com/dweissnat

- username : dweissnat

- bio : Deserunt et nihil cupiditate dolorem. Aut est expedita enim itaque dolor cumque.

- followers : 1618

- following : 1923

facebook:

- url : https://facebook.com/weissnat2018

- username : weissnat2018

- bio : In aut et perferendis et. Cupiditate eius accusantium dolorem.

- followers : 1575

- following : 2539

twitter:

- url : https://twitter.com/weissnatd

- username : weissnatd

- bio : Inventore voluptas quo ex occaecati qui. Praesentium nostrum optio tempore ex voluptatem.

- followers : 2012

- following : 968