Do you ever wonder where you truly stand with your money? It’s a question many of us ponder, perhaps more often than we realize. Knowing your financial position, you see, provides a sort of personal map for your money journey. This map, in a way, shows you where you are right now, giving you a chance to plan your next steps with a bit more confidence.

Think of it like taking a photo of your money situation at a specific moment. This single picture, or data point, is what we call your net worth. It’s a very simple idea, really, but it holds a lot of power for anyone looking to get a better handle on their finances. You might be surprised just how much clarity it can bring to your money thoughts.

This article will help you understand what net worth means, why it matters so much, and how you can figure out your own number. We'll also talk about how to make that number grow over time, so you can feel more secure about your financial future. It’s actually pretty straightforward to get started, you know.

Table of Contents

- What is Net Worth?

- Why Your Net Worth Matters

- Calculating Your Net Worth: A Simple Formula

- Understanding the Numbers: Average and Median Net Worth

- Growing Your Net Worth: Practical Steps

- Common Questions About Net Worth

- Taking Action Today

What is Net Worth?

Net worth is, quite simply, what you own minus what you owe. That's really all there is to it. It’s a figure that gives you a quick look at your financial health at a particular moment. This number, in a way, shows your overall money position.

The concept applies to both individuals and businesses. For a person, it means gathering up the value of everything they possess. Then, you subtract all the money they have to pay out. It’s a snapshot, just like a photograph, of your money standing.

It’s one data point, you see, that you can use to keep track of your money progress. My text says it provides a snapshot of a person's financial position. This figure can be a really helpful guide for your money plans, actually.

Why Your Net Worth Matters

Knowing your net worth is more than just a number; it’s a powerful tool. It helps you see where you are on your money journey. This understanding, in a way, can guide your financial decisions for the future.

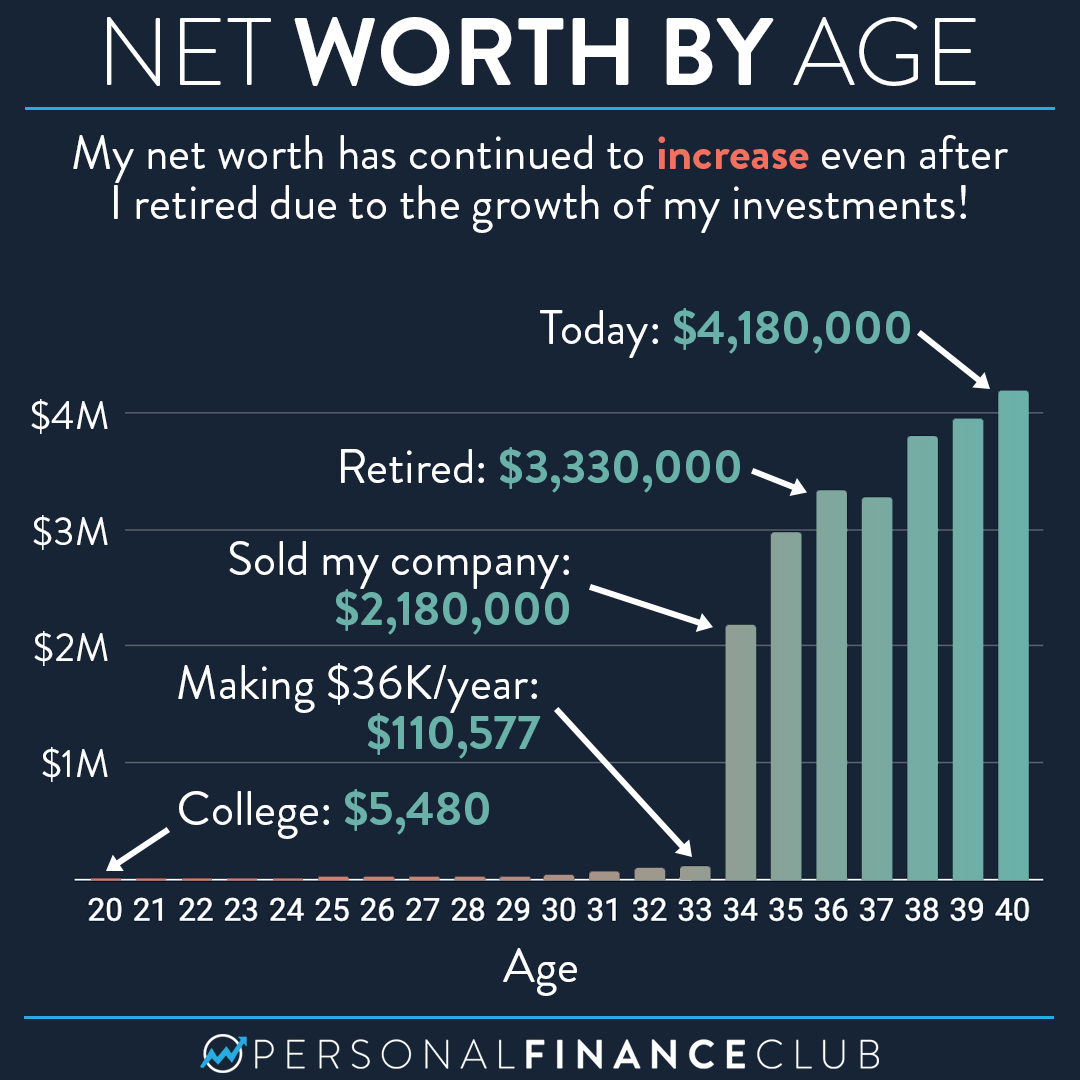

It helps you track your financial health over time. If your net worth is going up, that's generally a good sign. It means you are, perhaps, building more wealth. This tracking can give you a lot of peace of mind, too.

This number helps you set money goals. If you want to save for a house, or maybe retire early, your net worth shows your starting point. It's a bit like using a map to figure out how far you've traveled and how much more you need to go. You can, for instance, aim for a specific net worth number.

Calculating Your Net Worth: A Simple Formula

Calculating your net worth is a straightforward process. You gather up everything you own, which are your assets. Then, you list everything you owe, which are your liabilities. The formula is really quite simple: Assets minus Liabilities equals Net Worth. My text explains it as "what you own minus what you owe."

This calculation gives you a clear number. It shows you exactly where you stand financially today. Many people, you know, find this exercise to be quite eye-opening. It's a very practical step to take.

There are, in fact, many free net worth calculators available online. These tools can make the process even easier. They help you put in your numbers and see the result quickly, giving you a quick summary of your money situation.

What Are Assets?

Assets are things you own that have value. They are items that could be turned into cash, or things that help you make more money. My text mentions "cash savings, investments, and value of your home" as examples. These are, you know, common types of assets.

Some assets are easy to turn into cash, like money in your checking account. Others, like a house, might take more time. But they still add to your overall financial picture. It's important to list all of them, honestly.

Here are some examples of common assets:

- Money in bank accounts (checking, savings)

- Investment accounts (stocks, bonds, mutual funds, retirement accounts like 401(k)s or IRAs)

- The current market value of your home or other real estate

- The value of vehicles you own (cars, motorcycles)

- Valuable personal possessions (jewelry, art, collectibles, if they have significant resale value)

- Any money owed to you

You want to be thorough when listing these. Each item, you see, contributes to your overall wealth. It's a very important part of the calculation.

What Are Liabilities?

Liabilities are debts or financial obligations. They are the money you owe to others. My text calls them "all that you owe." These are the things that reduce your net worth, naturally.

Think of them as the opposite of assets. They represent money that will eventually leave your pocket. It's important to be honest about all your debts, too.

Here are some common examples of liabilities:

- Mortgage balances on your home

- Car loans

- Student loans

- Credit card balances

- Personal loans

- Medical bills

- Any other money you owe

Adding up all your liabilities gives you a clear picture of your total debt. This number is just as important as your total assets. It helps you see the full story of your money, basically.

Understanding the Numbers: Average and Median Net Worth

When you look at your net worth, you might wonder how you compare to others. It's a natural thing to do, you know. My text provides some interesting figures from recent surveys that can give you some perspective.

According to Schwab’s 2024 Modern Wealth Survey, Americans felt it took an average net worth of $2.5 million to be considered wealthy. This figure is, you know, a bit higher than previous years. It shows how perceptions of wealth can shift.

For a broader view, my text also shares data from 2022. The median net worth for all Americans was $192,900. The average net worth was higher, at $1.06 million. The average, you see, can be skewed upwards by people with extremely high net worths. This is why the median figure is often a better representation for the typical person.

These numbers are just benchmarks, of course. Your personal net worth journey is unique. It's more about your own progress than comparing yourself to everyone else, actually. What matters most is that your number is moving in the direction you want it to go.

Growing Your Net Worth: Practical Steps

Once you know your net worth, the next step is often to think about making it grow. This is where active money management comes in. It's about making smart choices that increase your assets or reduce your liabilities, or both, in a way.

Improving your net worth is a gradual process. It takes time and consistent effort. But even small steps can make a big difference over the long run, you know. It’s a bit like tending a garden; consistent care yields growth.

Many people find that setting clear goals helps them stay on track. Whether it's paying off a specific debt or saving for a down payment, having a target can be very motivating. It gives you something to work towards, definitely.

Increase Your Assets

One way to boost your net worth is to add more valuable things to your side of the ledger. This means finding ways to accumulate more money or things that hold value. It’s a very direct path to growth.

Saving money is a fundamental step. Putting money aside regularly, even small amounts, can build up over time. Consider setting up an automatic transfer to a savings account each payday. This makes it easier, you know, to stick with it.

Investing is another powerful way to grow assets. When you invest, your money has the chance to earn more money. This could be through stocks, bonds, or real estate. Learning about different investment options can be quite helpful, you see. You can learn more about investing strategies on our site.

Increasing your income also helps. Finding ways to earn more money means you have more to save and invest. This could involve asking for a raise, taking on a side job, or developing new skills. Every extra dollar can contribute to your assets, basically.

Reduce Your Liabilities

The other side of the net worth equation is reducing what you owe. Every debt you pay off directly increases your net worth. It’s like shedding a financial burden, which feels pretty good, honestly.

Focus on paying down high-interest debts first, like credit card balances. These debts can grow quickly because of the interest. Getting rid of them frees up more of your money for other goals. It's a very smart move, in a way.

Creating a debt repayment plan can be really effective. This might involve the "snowball method" (paying off smallest debts first) or the "avalanche method" (paying off highest interest debts first). Pick a method that feels right for you and stick with it. This kind of plan provides a clear path forward, you know.

Try to avoid taking on new, unnecessary debt. Before making a large purchase, consider if you can pay for it with cash. This helps keep your liabilities from growing. It’s a good habit to develop, actually.

Review Regularly

Your net worth is a snapshot, as my text says, at a specific point in time. It changes as your assets and liabilities change. That’s why it's a good idea to check it regularly. This could be once a month, once a quarter, or once a year, you know.

Reviewing your net worth helps you see your progress. It also lets you adjust your plans if needed. Maybe you paid off a loan, or perhaps an investment grew. These changes will show up in your net worth calculation. It’s a very practical way to stay on top of your money.

Seeing your net worth grow can be a big motivator. It shows that your efforts are paying off. If it dips, it can prompt you to look at why and make changes. It’s a kind of financial check-up, basically. This helps you keep your money health on track.

Common Questions About Net Worth

Many people have similar questions when they start thinking about their net worth. Here are some common ones, with straightforward answers.

Is a high net worth always good?

Generally, a higher net worth is seen as a sign of good financial health. It means you own more than you owe. However, the true value is in what that net worth allows you to do. It’s about having options and security, you know, not just a big number. It's also about how you feel about your money situation.

How often should I calculate my net worth?

Calculating your net worth once a year is a good starting point for most people. Some like to do it more often, perhaps quarterly. The key is to do it consistently. This helps you track your progress over time, which is very important. It shows you the trend, basically.

Can my net worth be negative?

Yes, your net worth can absolutely be a negative number. This happens when your total liabilities are greater than your total assets. It’s common for younger people, or those with significant student loans or mortgages. A negative net worth is a starting point, not a permanent state. It just means you have more work to do to build up your assets, or reduce your debts, honestly.

Taking Action Today

Understanding your net worth is a powerful first step towards taking control of your financial future. It provides a clear, honest picture of where you stand. This clarity, you know, can help you make better decisions about your money.

Remember, everyone has a net worth number. My text says, "Everyone has a net worth number." It's not just for the very wealthy. It's for anyone who wants to understand their financial situation. This number is a starting point for your money plans.

Take a moment today to gather your financial information. Use a free net worth calculator to figure out your number. It’s a simple action that can lead to big insights. You can use our free calculator to learn yours, for instance. You can also explore other financial tools on our site for more help.

Once you have that number, you can start to set goals and make a plan. Whether it’s paying off debt, saving for a big purchase, or building wealth for retirement, your net worth is your guide. It’s a very practical tool for financial progress, honestly. This simple calculation can be quite empowering, you know.

Detail Author:

- Name : Ephraim Predovic DVM

- Username : lauren.johnson

- Email : vallie66@yahoo.com

- Birthdate : 1975-05-12

- Address : 569 Bednar Turnpike North Heathfurt, NH 54510-6121

- Phone : 352.266.8571

- Company : Beer-Daniel

- Job : Stock Clerk

- Bio : Nihil animi minima temporibus maiores ut voluptatem. Vel est incidunt voluptas placeat nobis consequuntur. Ex quo rem iure et accusantium rem consequatur.

Socials

twitter:

- url : https://twitter.com/okeynikolaus

- username : okeynikolaus

- bio : Ratione officia nihil nesciunt dolor. Fuga unde tempore sunt magnam autem ullam. Natus quaerat asperiores quae eos dolores unde.

- followers : 1628

- following : 595

facebook:

- url : https://facebook.com/nikolauso

- username : nikolauso

- bio : Sed architecto aut dignissimos.

- followers : 1515

- following : 1647