Have you ever wondered about the financial standing of someone as dynamic as Marcus Lemonis? It's a question many people ponder, especially when they see his impactful work in the business world. His journey from humble beginnings to building a significant business empire is, in a way, quite a story, and understanding what contributes to his financial strength can offer some really interesting insights into how wealth is built and managed in the modern economy.

So, when we talk about Marcus Lemonis's worth, we're not just looking at a number; we're considering the culmination of smart decisions, strategic investments, and a deep understanding of what makes businesses tick. He's known for his straightforward approach, often focusing on the core elements of people, process, and product. This philosophy, you know, has helped him turn around struggling companies and build successful ventures, which naturally impacts his overall financial picture.

This article will take a closer look at what goes into Marcus Lemonis's financial standing. We'll explore his background, the types of businesses he's involved with, and how his unique approach to business contributes to his personal wealth. It's a fascinating look at how a keen business mind translates into tangible value, and, you know, it might even shed some light on what to consider when thinking about your own financial moves.

Table of Contents

- Who Is Marcus Lemonis? A Brief Biography

- The Foundations of His Financial Strength

- Business Ventures and Investment Philosophy

- Lemonis and the World of Consumer Finance

- How Business Principles Shape Personal Worth

- Assessing Value and Making Smart Financial Moves

- The Impact of Strategic Thinking on Wealth

- Frequently Asked Questions About Marcus Lemonis

- Final Thoughts on Marcus Lemonis's Worth

Who Is Marcus Lemonis? A Brief Biography

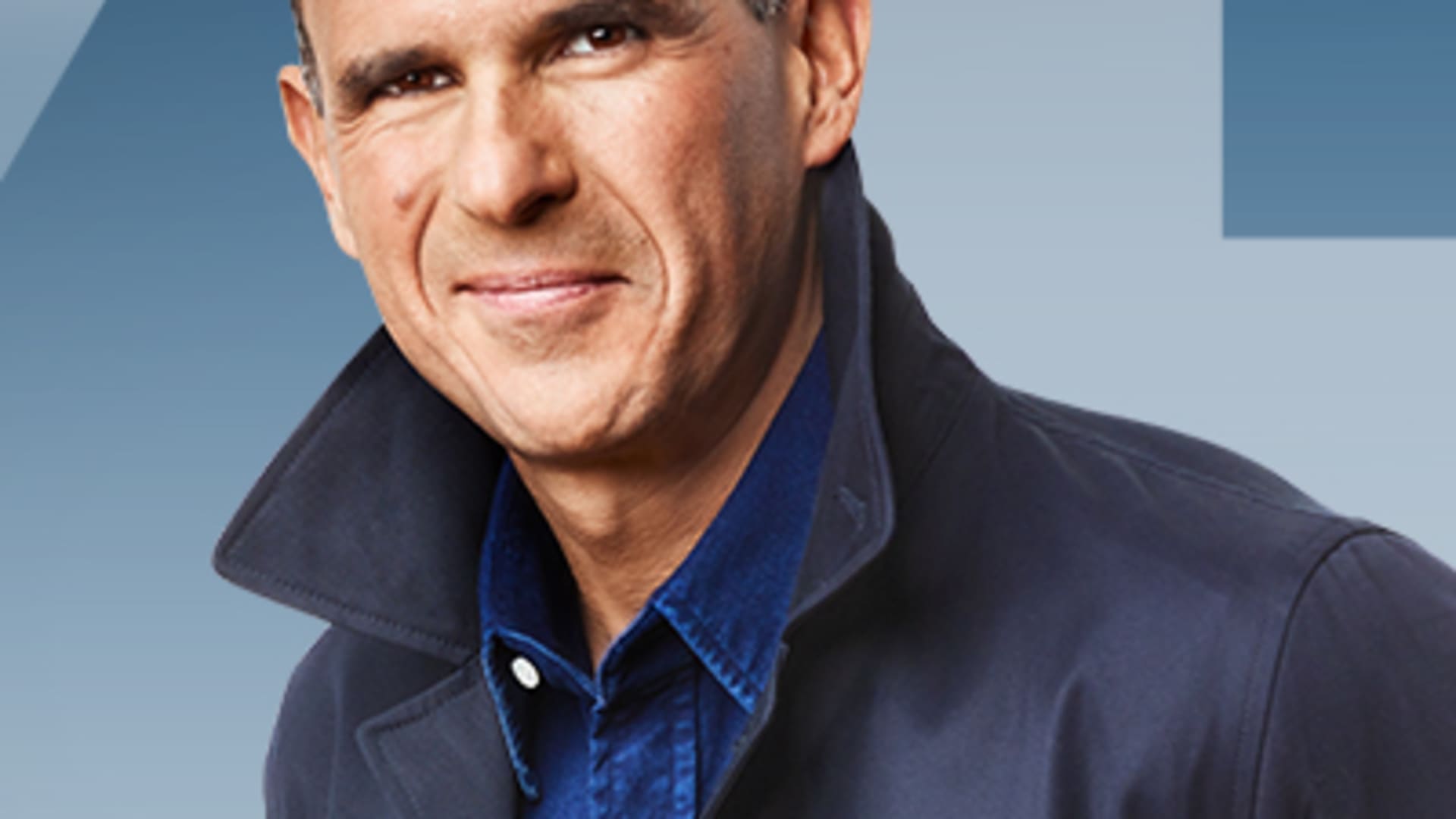

Marcus Lemonis, quite a well-known figure, is a Lebanese-American businessman, investor, television personality, and philanthropist. He's probably best recognized for his role as the host of the CNBC reality show, "The Profit," where he offers struggling small businesses capital investments and his business expertise in exchange for a stake in their company. His journey started in Beirut, Lebanon, and he was adopted by a Greek couple living in Miami, Florida, when he was just a baby. That, you know, is a pretty unique start for anyone.

He got his start in the automotive industry, working for his family's business, which eventually led him to RVs and camping. This background, actually, gave him a practical, hands-on understanding of retail and consumer behavior. He learned early on the importance of understanding a customer's needs and how to build a lasting business. It's fair to say, his early experiences really shaped his approach to business, which is something you see reflected in his advice on "The Profit."

Over the years, Marcus has built a reputation for being a straight talker, often emphasizing the "three P's" – People, Process, and Product – as the core components of any successful business. He believes that if you get these three things right, nearly any business can thrive. This philosophy, you know, is something he applies to all his ventures, and it's a significant part of why he's been able to build such a considerable financial presence.

Personal Details and Bio Data

| Detail | Information |

|---|---|

| Full Name | Marcus Anthony Lemonis |

| Date of Birth | November 16, 1973 |

| Place of Birth | Beirut, Lebanon |

| Nationality | American |

| Occupation | Businessman, Investor, Television Personality, Philanthropist |

| Known For | Host of CNBC's "The Profit," CEO of Camping World |

| Education | Bachelor of Arts in Political Science, Marquette University |

| Spouse | Roberta Raffel |

The Foundations of His Financial Strength

When we talk about Marcus Lemonis's worth, it's really built on several key pillars. His primary source of wealth, you could say, comes from his role as the Chairman and CEO of Camping World Holdings, Inc., which is a huge retail company for recreational vehicles and outdoor gear. This company, which is publicly traded, represents a big part of his overall financial picture, and, you know, its performance certainly impacts his personal wealth.

Beyond Camping World, Marcus has a vast portfolio of investments, many of which are a direct result of his work on "The Profit." Through the show, he's invested in, and often taken ownership stakes in, a wide array of small businesses across various industries, from food and fashion to services and manufacturing. These investments, which are quite diverse, add significantly to his assets and, in a way, spread out his financial risk.

He also generates income from his television appearances, speaking engagements, and other media ventures. While these might seem like smaller pieces of the puzzle compared to his main business interests, they certainly contribute to his overall financial standing. So, it's a combination of big corporate leadership, strategic small business investments, and media presence that really underpins his financial strength, and, you know, it's a pretty robust model.

Business Ventures and Investment Philosophy

Marcus Lemonis's investment philosophy is, in a way, quite distinctive. He often says he invests in people first, then the process, and finally the product. This means he looks for strong leadership, efficient operations, and a good product or service, in that order. He's not just throwing money at businesses; he's getting involved, providing guidance, and helping them restructure to become profitable. This hands-on approach, you know, is a hallmark of his strategy.

He's famous for his "three P's" approach: People, Process, and Product. He believes that if a business has good people who are passionate and capable, a solid process for how things get done, and a product that customers want, it has the potential to succeed. For example, he might walk into a business, and if the people aren't engaged or the process is messy, he'll address those issues first, even before looking at the product itself. This focus on fundamentals, you know, helps him build lasting value.

His ventures span a wide range of industries. You might see him investing in a small bakery one day and a manufacturing plant the next. This diversity is, in some respects, a smart way to manage risk and tap into different market opportunities. He's always looking for businesses that have potential but are just missing that one key element, whether it's capital, a better process, or stronger leadership. It's this knack for spotting potential and then nurturing it that really defines his business ventures, and, you know, it's quite effective.

Lemonis and the World of Consumer Finance

While Marcus Lemonis is primarily known for his work with small businesses and retail, his insights into value and financial management certainly touch upon the broader world of consumer finance. We see, for example, many people trying to make smart choices with their money, like finding the best savings accounts. My text, actually, talks a lot about "Marcus" by Goldman Sachs, noting that it's "fine" and "FDIC insured," with "competitive rates." This kind of discussion about where to put your money, you know, is very much in line with the practical financial advice Marcus Lemonis often shares.

For instance, the text mentions how "Marcus is fine, but they were very quick to cut rates when the fed did," and how "Affirm savings is been stable at 0.65% even with the rate changes over the past few years." These observations highlight the dynamic nature of interest rates and the importance of choosing a stable option. Marcus Lemonis, in his own business dealings, is always looking at the financial health and stability of companies, much like a savvy saver looks at their bank. He's always assessing the "worth" of an investment, whether it's a business or a savings account, and, you know, that's a key takeaway.

The text also brings up the idea of getting "about $215 per month" on a significant deposit, leading someone to think, "Seems too good to be true lol." This skepticism, you know, is something Marcus Lemonis would likely appreciate. He often advises people to look closely at the numbers and not just take things at face value. The discussion about transfer times, like how it "took almost 6 days to transfer the money" from Marcus through Chase, or worries about "Goldman Sachs will pull out of consumer banking soon," points to the need for due diligence and understanding the fine print in financial services. These are all considerations that someone like Marcus Lemonis, who values transparency and efficiency, would certainly emphasize.

It's interesting to note that while the "Marcus" in the provided text refers to the bank, Marcus Lemonis's business principles apply broadly to how consumers should think about their own financial decisions. Just as he scrutinizes a business's "process," a consumer might look at a bank's transfer times or its history of rate changes. And just as he assesses the "people" behind a company, a consumer might consider the customer service of a financial institution. This parallel, you know, shows how his business acumen extends beyond just large corporate deals.

The text also mentions other high-yield accounts like "ally, cap one, discover." This variety, you know, means consumers have choices, and Marcus Lemonis would likely encourage thorough research before making a decision. His approach is always about understanding the true value and the underlying mechanics, whether it's a business or a personal financial product. He's very much about getting the most out of every dollar, and, you know, that includes ensuring your savings are working hard for you. Learn more about saving money wisely on our site, and link to this page for more insights on financial planning.

How Business Principles Shape Personal Worth

Marcus Lemonis's personal worth is, in many ways, a direct reflection of his business principles. His belief in "people, process, and product" isn't just a catchy phrase for TV; it's how he genuinely operates. By investing in and improving businesses, he creates value, and that value, you know, naturally adds to his own financial standing. It's a cyclical relationship where his expertise helps companies grow, which then increases the worth of his investments.

He's very much about long-term growth rather than quick flips. This patient approach, actually, allows businesses to stabilize and build sustainable profitability, which is a much more reliable way to build wealth over time. Rather than chasing fleeting trends, he focuses on fundamental improvements that make a business inherently stronger. This kind of stability, you know, is something any investor, big or small, can appreciate.

His willingness to take calculated risks, but only after thoroughly assessing the "three P's," is another key factor. He's not afraid to put his own money on the line, but he does so with a clear strategy and a deep understanding of the business he's getting into. This kind of disciplined risk-taking, you know, is often what separates successful investors from others. He understands that real worth comes from building something solid and enduring.

The idea of getting "some interest vs no interest is a smart move," as mentioned in the provided text, speaks to the basic principle of making your money work for you. Marcus Lemonis applies this on a much larger scale, by making his capital work hard in businesses that can generate significant returns. His ability to identify and then fix inefficiencies in companies is, in a way, like finding "free money" or untapped potential, which then boosts the company's, and his own, worth.

So, his personal worth isn't just a number accumulated by chance; it's the result of consistently applying sound business principles, focusing on the fundamentals, and making strategic decisions that foster growth and stability. It's a testament, you could say, to the power of a clear vision and disciplined execution in the business world.

Assessing Value and Making Smart Financial Moves

Assessing value is a core skill for Marcus Lemonis, and it's something everyone, from a big investor to someone managing their personal savings, can learn from. When he looks at a business, he's not just looking at its current profits; he's looking at its potential, its people, and its processes. This holistic view, you know, helps him see the true worth that might not be immediately obvious.

For example, the text mentions a situation where someone has "$140,000 in my chase bank account" and is "going to put $110,000 on marcus" because "according to the interest rate i’ll get about $215 per month." This is a clear example of someone assessing the value of different financial products. They're comparing getting "$0 at chase" to getting interest with Marcus. This kind of comparison, you know, is exactly what Marcus Lemonis does with businesses, looking for where the money can work hardest.

The question "Why doesn’t everyone use it then?" when something seems "too good to be true," is a natural one. It highlights the need for due diligence and understanding the nuances of any financial decision. Marcus Lemonis often uncovers hidden problems in businesses that might seem appealing on the surface. He'd advise looking beyond the immediate gain to understand the risks, the long-term implications, and the overall reliability of the product or service. This careful approach, you know, is vital for making truly smart financial moves.

The discussion about transfer times and concerns about a bank "allegedly slowly ceasing operations" also points to the importance of looking at the operational side of things, not just the advertised rates. Marcus Lemonis, actually, dives deep into a company's operations to ensure they are sound and sustainable. He'd tell you that a great rate means little if the service is unreliable or if there's a risk of the provider pulling out. This attention to detail, you know, is a big part of how he assesses true value.

So, whether you're evaluating a multi-million dollar business or deciding where to put your savings, the principles remain similar: look at the fundamentals, understand the risks, compare options carefully, and don't be afraid to ask "why." This thoughtful approach, you know, is what helps build and protect financial worth. For more information on making smart financial choices, you might find this article useful: How Marcus Lemonis Made His Money.

The Impact of Strategic Thinking on Wealth

Strategic thinking is, perhaps, the most powerful tool Marcus Lemonis uses to build wealth. It's not just about having money to invest; it's about knowing *where* and *how* to invest it to create the most impact. His approach is always about finding leverage points, whether it's improving a company's process, empowering its people, or refining its product. These strategic interventions, you know, are what transform struggling businesses into profitable ones.

Consider the example from the text, where someone is moving a large sum of money to a high-yield savings account to gain interest. This is a strategic move, designed to make money work harder. Marcus Lemonis applies this same principle on a grander scale, by strategically deploying capital into businesses that can generate much larger returns. He's very much about maximizing the potential of every asset, and, you know, that includes his own financial resources.

His ability to identify and then execute on a clear vision for a business is a key aspect of his strategic thinking. He doesn't just buy companies; he buys into their potential and then actively works to realize that potential. This involves making tough decisions, streamlining operations, and sometimes completely overhauling a business model. This kind of active management, you know, is what truly drives the growth and increases the worth of his investments.

The discussions in the provided text about current APY rates, promotional CD rates, and federal interest rates, all highlight a dynamic financial environment. Marcus Lemonis's strategic thinking means he's always aware of these broader economic currents and how they might affect his businesses and investments. He's not just reacting to changes; he's anticipating them and positioning his ventures accordingly. This forward-looking approach, you know, is essential for sustained wealth creation.

Ultimately, Marcus Lemonis's worth is a reflection of his consistent application of strategic thinking across all his business endeavors. He shows that wealth isn't just about accumulating assets, but about intelligently deploying them to create even more value. It's a powerful lesson in how smart decisions, rather than just sheer volume of capital, can truly shape a financial legacy.

Frequently Asked Questions About Marcus Lemonis

Here are some common questions people often ask about Marcus Lemonis:

What is Marcus Lemonis's primary source of wealth?

His main source of wealth comes from his leadership role as Chairman and CEO of Camping World Holdings, Inc., a large retail company focused on recreational vehicles and outdoor gear. He also has significant investments in numerous small businesses through his work on "The Profit," and, you know, these ventures really add to his overall financial picture.

How does Marcus Lemonis choose which businesses to invest in?

Marcus Lemonis famously uses his "three P's" philosophy: People, Process, and Product. He looks for strong, passionate people running the business, efficient and clear processes, and a desirable product or service. If any of these elements are weak, he typically works to improve them as part of his investment. He's very much about fixing the fundamentals, and, you know, that's a key part of his strategy.

Is Marcus Lemonis involved with Marcus by Goldman Sachs?

No, Marcus Lemonis is not involved with Marcus by Goldman Sachs. Marcus by Goldman Sachs is a separate consumer banking division of Goldman Sachs, offering savings accounts and loans. The name "Marcus" for the bank is actually a tribute to Marcus Goldman, one of the founders of Goldman Sachs. It's a common point of confusion, but, you know, they are entirely distinct entities.

Final Thoughts on Marcus Lemonis's Worth

Thinking about Marcus Lemonis's worth gives us a chance to see how business principles truly translate into financial success. It's not just about the big numbers, but about the consistent application of sound strategies, a focus on the core elements of any enterprise, and a willingness to get hands-on. His journey, you know, shows that value is created through smart decisions and dedicated effort, whether you're running a huge corporation or managing your personal savings.

His approach to business, which emphasizes people, process, and product, offers a valuable framework for anyone looking to build something meaningful, whether it's a company or their own financial security. It's a reminder that understanding the fundamentals and making informed choices, like those discussed in the context of high-yield savings accounts, are key steps. So, as you consider your own financial path, remember the lessons from Marcus Lemonis's world, and, you know, think about what truly adds value.

Detail Author:

- Name : Gracie Wisozk

- Username : casimir.lueilwitz

- Email : nblick@yahoo.com

- Birthdate : 1985-09-22

- Address : 6315 Nienow Points Mikelfort, MN 13633

- Phone : 234-433-6832

- Company : Wiza, Ernser and Dickinson

- Job : Tire Changer

- Bio : Animi dolorum est porro occaecati et. Dolor at natus commodi sit recusandae minus. Repellat eligendi ut mollitia tempore voluptatem ab.

Socials

instagram:

- url : https://instagram.com/kian9242

- username : kian9242

- bio : Magnam voluptates voluptas velit. Earum sed iusto alias autem.

- followers : 2364

- following : 289

facebook:

- url : https://facebook.com/kian_kuvalis

- username : kian_kuvalis

- bio : Exercitationem ut dolore nihil quo voluptatum non officiis quos.

- followers : 6682

- following : 1156

twitter:

- url : https://twitter.com/kuvalisk

- username : kuvalisk

- bio : Ratione maiores voluptas assumenda est sapiente. Quia aliquid reprehenderit et aut. Possimus accusantium cum culpa possimus dolores vel debitis.

- followers : 529

- following : 384