Have you ever wondered about the financial standing of successful business people, particularly someone like Marcus Lemonis? It's a common thought, and, you know, many folks are curious about how wealth is built. When we talk about figures like his, it's often Forbes that comes to mind as a key source for such valuations. This kind of information, so, gives us a peek into the world of business and investment strategies.

Understanding the financial details of public figures, especially those known for their business prowess, can be really quite insightful. Marcus Lemonis, with his visible role in helping struggling businesses, tends to spark a lot of interest. People are naturally drawn to stories of financial success and, basically, how it's achieved.

This article will walk you through what goes into estimating the financial worth of someone like Marcus Lemonis, often as reported by publications like Forbes. We'll look at the principles behind these figures and, in a way, what makes his approach to business unique. It's about getting a clearer picture of the financial side of a well-known personality.

Table of Contents

- Who is Marcus Lemonis? A Brief Look at His Journey

- Understanding Net Worth: What Does Forbes Look At?

- Marcus Lemonis' Business Acumen: The "Three Ps" in Action

- Diversification and Investment Strategies

- The Impact of "The Profit" and Media Ventures

- Factors Influencing Financial Valuations Over Time

- FAQs about Marcus Lemonis' Financial Standing

- Navigating Your Own Financial Path

Who is Marcus Lemonis? A Brief Look at His Journey

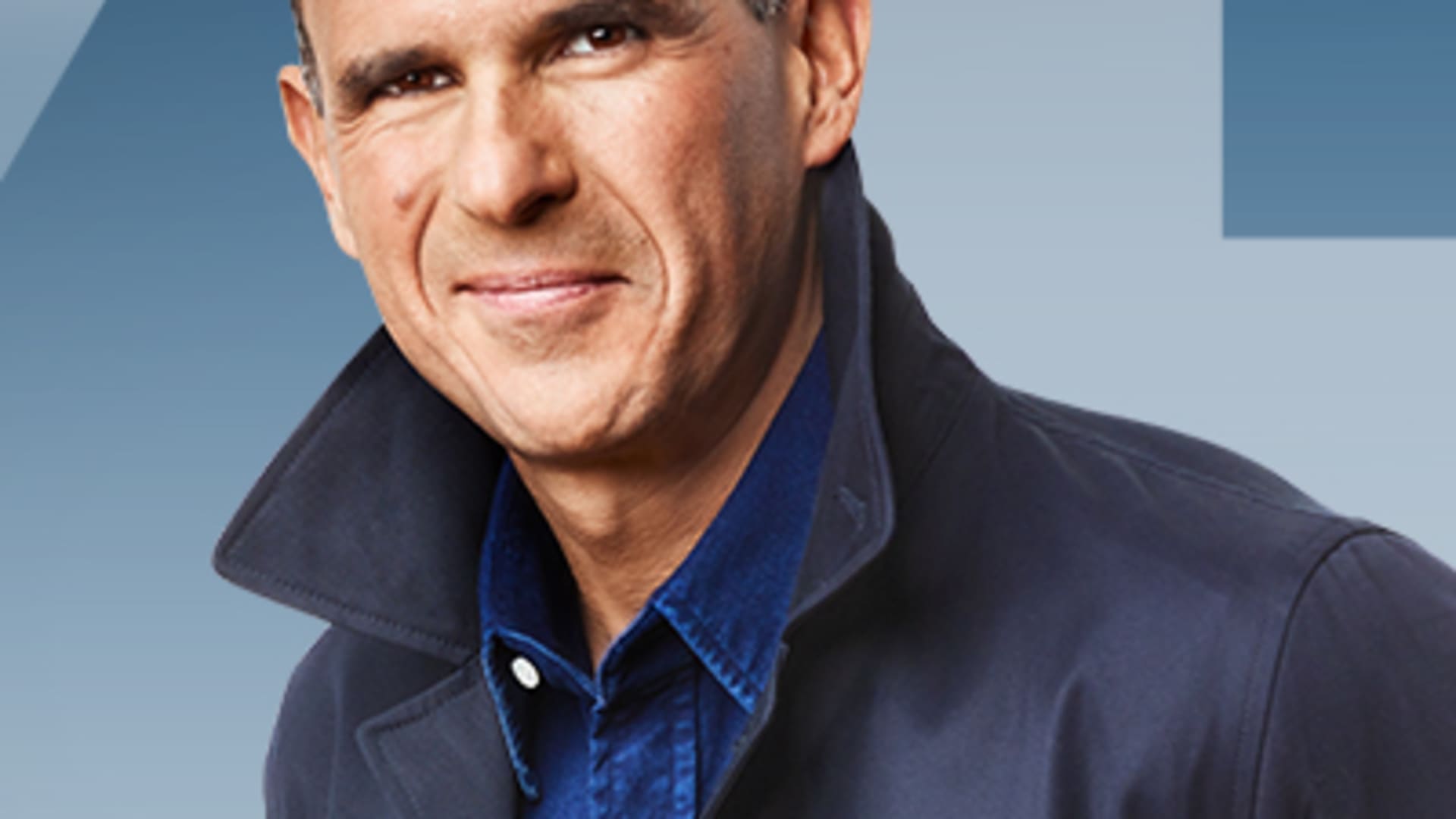

Marcus Lemonis is widely recognized for his work as a businessman, investor, and television personality. He's probably best known for hosting "The Profit" on CNBC, where he invests in and helps small businesses. His journey, you know, started quite early in the automotive industry, which is pretty interesting.

He has a reputation for being hands-on, often taking a direct role in the companies he supports. This practical approach, so, is a big part of his public image and how he builds value. It's not just about money for him; it's about making things work better.

His background includes leadership roles in large companies, which gave him a broad perspective on how businesses operate. This experience, arguably, has been a cornerstone of his success and, in a way, his ability to spot potential in various ventures.

Personal Details and Bio Data

| Full Name | Marcus Anthony Lemonis |

| Born | November 16, 1973 |

| Birthplace | Beirut, Lebanon |

| Nationality | American |

| Known For | Businessman, Investor, Television Personality ("The Profit") |

| Primary Industry | Retail, Automotive, Business Investments |

Understanding Net Worth: What Does Forbes Look At?

When publications like Forbes report on someone's net worth, they are essentially estimating the total value of their assets minus their liabilities. It's a complex process, really, and involves looking at many different financial pieces. For a public figure like Marcus Lemonis, this would include his ownership stakes in various businesses.

They consider things like private company valuations, real estate holdings, and any public stock investments. So, if Marcus owns a significant portion of a company that isn't publicly traded, Forbes would have to estimate that company's value. This is, you know, a very important part of the calculation.

Other elements that play a part are cash on hand, personal assets, and even earnings from media appearances. They also factor in any debts or financial obligations. It's a snapshot, basically, of someone's financial standing at a particular moment, which can, of course, change over time.

Forbes uses a team of researchers and financial experts to gather this information, often relying on public filings, interviews, and market data. They aim for accuracy, but it's important to remember these are always estimates. For instance, the value of a private business can be a bit harder to pin down precisely than publicly traded stocks, as a matter of fact.

The methodology is quite thorough, trying to account for all visible and sometimes less visible assets. They might look at recent sales of comparable companies or even the revenue and profit margins of businesses Marcus has invested in. This approach helps them arrive at a figure that is, usually, considered reliable for public reporting.

It's also worth noting that these figures are dynamic. Market conditions, business performance, and new investments can cause someone's net worth to fluctuate significantly. So, a figure reported one year might be different the next, which is, you know, pretty standard in the world of finance.

Marcus Lemonis' Business Acumen: The "Three Ps" in Action

Marcus Lemonis is well-known for his "Three Ps" philosophy: People, Process, and Product. He believes these are the fundamental pillars of any successful business. This framework, you know, guides his investment decisions and how he approaches turning companies around.

First, "People." He often emphasizes that a business is only as good as the individuals running it. He looks for passionate, dedicated, and capable teams. This focus on human capital is, really, a cornerstone of his strategy. He might invest in a struggling business if he believes in the people behind it, even if other aspects need work.

Next, "Process." This refers to the operational efficiency and systems within a company. A good product with a messy process can still fail, he argues. He often streamlines operations, improves supply chains, and implements better financial controls. This attention to detail, so, helps businesses run more smoothly and profitably.

Finally, "Product." While he stresses that a great product isn't enough on its own, it's still essential. He looks for products or services that meet a real market need and have potential for growth. The product must be something customers want and are willing to pay for, which is, you know, pretty obvious but often overlooked.

His application of these "Three Ps" has been a consistent theme throughout his career, whether in his own businesses or those he invests in. This methodical approach, apparently, allows him to identify core issues and implement effective solutions, which, in turn, boosts the value of these companies. This, ultimately, contributes to his overall financial standing, as the success of his investments directly impacts his wealth.

He often takes a significant equity stake in the businesses he helps, meaning that as those companies grow and become more profitable, his own wealth increases. This model, so, is a direct link between his business philosophy and his personal financial growth. It's a clear example of how strategic investment can build substantial value over time.

Diversification and Investment Strategies

Successful individuals with substantial wealth, like Marcus Lemonis, typically employ a range of investment strategies to protect and grow their assets. Diversification is a very important concept here, meaning they don't put all their eggs in one basket. They spread their investments across different types of assets and industries.

For someone like Marcus, this might include investments in various sectors beyond his core retail and automotive interests. He could have holdings in real estate, technology companies, or even financial instruments. This approach, you know, helps to reduce risk, as a downturn in one sector might be offset by growth in another.

His public investments through "The Profit" are just one part of a potentially much broader portfolio. While those are visible, it's likely he has many other private investments that are not widely known. These private ventures, in a way, form a significant portion of his overall wealth.

He's also known for investing in distressed businesses, which can be a higher-risk, higher-reward strategy. If he successfully turns these companies around, the value of his investment can grow significantly. This kind of hands-on investing, basically, requires deep business insight and a willingness to get involved in the day-to-day operations.

Moreover, managing liquidity and cash flow is a vital part of maintaining a strong financial position. Having access to funds allows for new investment opportunities and provides a buffer during economic shifts. This careful management of resources is, usually, a hallmark of seasoned investors.

The long-term view is also key. Rather than seeking quick returns, many successful investors aim for sustained growth over years or even decades. This patient approach allows investments to mature and compound, leading to more substantial wealth accumulation. It's a strategy that, apparently, has served many well.

The Impact of "The Profit" and Media Ventures

Marcus Lemonis' role on "The Profit" has undeniably elevated his public profile and, in some respects, his brand. The show provides a platform for him to showcase his business expertise and investment philosophy. This visibility, you know, opens up additional opportunities beyond direct business investments.

Being a television personality can lead to various income streams, such as speaking engagements, book deals, and endorsements. These ventures, basically, contribute to overall financial standing, even if they aren't the primary source of wealth. It's about leveraging a public persona.

The show also acts as a powerful marketing tool for his other business interests. When viewers see his success in turning companies around, it builds trust and credibility. This trust, so, can translate into more business opportunities and a stronger reputation in the investment community.

His media presence allows him to reach a wide audience, sharing his business insights and inspiring others. This engagement, arguably, reinforces his position as a respected authority in the business world. It's a cycle where his media work supports his business ventures, and his business success fuels his media career.

The businesses featured on "The Profit" often see increased exposure and sales, which benefits both the business owners and Marcus himself, given his investment. This symbiotic relationship is, in a way, a clever model for wealth creation and brand building. It shows how media can be a powerful tool in the business world.

Factors Influencing Financial Valuations Over Time

A person's financial standing, especially someone with diverse investments like Marcus Lemonis, is always subject to change. Several factors can influence these valuations over time. Market conditions, for instance, play a very big part. A strong economy can boost asset values, while a downturn can reduce them.

The performance of individual businesses within his portfolio is also crucial. If a company he owns or has invested in performs exceptionally well, its value increases, which directly impacts his net worth. Conversely, if a business struggles, it can have the opposite effect. This is, you know, pretty straightforward.

Interest rates, like those mentioned in the provided text about Marcus (Goldman Sachs) and their quick adjustments when the Fed changes rates, can also affect valuations. Higher rates can make borrowing more expensive for businesses, potentially slowing growth, while lower rates can stimulate investment. This dynamic is, basically, always in play.

New investments or divestitures also alter a person's financial picture. When Marcus makes a new investment, it changes his asset mix. If he sells a stake in a company, the cash received (or losses incurred) will affect his net worth. These transactions are, usually, ongoing for active investors.

Changes in public perception or brand value can also have an indirect impact. A strong, positive public image can open doors to new opportunities and partnerships, which might contribute to wealth growth. This human element, in a way, can be surprisingly important.

Tax policies and regulatory changes can also influence how wealth is structured and valued. Different tax environments can affect investment returns and the overall financial landscape for high-net-worth individuals. These external factors are, apparently, always something to consider.

So, while publications like Forbes provide estimates at a given time, it's important to remember that these figures are fluid. The true measure of financial success for someone like Marcus Lemonis is often in the sustained growth and adaptability of his business empire, rather than a single number.

FAQs about Marcus Lemonis' Financial Standing

Q1: How does Forbes calculate Marcus Lemonis' net worth?

Forbes calculates net worth by estimating the total value of a person's assets, like business ownership, real estate, and investments, and then subtracting any liabilities or debts. They use public records, financial filings, market data, and often interviews to get their figures. It's a comprehensive process that aims to provide a very accurate estimate, you know.

Q2: Does Marcus Lemonis' net worth change frequently?

Yes, a person's net worth, especially someone with active investments like Marcus Lemonis, can change quite frequently. This is because the value of his business holdings, stock market performance, new investments, and even economic conditions can fluctuate. So, the number reported one day might be different the next, which is, basically, typical for high-net-worth individuals.

Q3: What are the main sources of Marcus Lemonis' wealth?

Marcus Lemonis' wealth primarily comes from his extensive business investments, particularly his ownership stakes in various companies, including Camping World and other retail ventures. His earnings from "The Profit" television show and other media appearances also contribute, as do his real estate holdings and other diversified investments. It's a mix of different income streams, you know, that adds up.

Navigating Your Own Financial Path

Looking at figures like Marcus Lemonis' financial standing can be inspiring, and it often highlights the importance of sound financial principles. While most of us won't build an empire quite like his, there are still valuable lessons to take away. Understanding how assets grow and how to manage money effectively is, truly, a smart move for anyone.

Even small steps, like putting money into a high-yield savings account, can make a difference over time. As the text mentioned, "getting some interest vs no interest is a smart move." Accounts like Marcus by Goldman Sachs, Ally, or Discover offer competitive rates that are, usually, much better than traditional banks. For instance, if you have funds sitting in a checking account, like the $140,000 someone mentioned in Chase, moving a portion to a high-yield account could mean earning a good amount of interest each month, like the $215 per month estimate. It's a way to make your money work harder for you, which is, you know, a very good idea.

Exploring different savings options and understanding how they work is a step everyone can take. You might find that linking accounts for easier transfers, as suggested in the text, could simplify your financial life. Just remember to research transfer times and any potential concerns about an institution's operations, as some have noted. Learning more about financial planning on our site can help you get started.

The core idea is to be thoughtful about your money and where it lives. Whether it's through careful investing, saving, or understanding market trends, taking an active role in your financial future is always beneficial. For more insights into smart money moves, you could check out a reputable business news site for current financial advice. And to continue exploring various aspects of personal finance, you can always visit this page for more information.

![Marcus Lemonis' Net Worth [2022 Update]: Career & Charity](https://wealthypeeps.com/wp-content/uploads/2021/09/Marcus-Lemonis-watches.jpg)

Detail Author:

- Name : Prof. Gregg Reinger

- Username : borer.dina

- Email : linda.reichert@zemlak.com

- Birthdate : 1993-12-24

- Address : 653 Jarrod Loaf Bergestad, AR 11839-2357

- Phone : 1-216-737-2416

- Company : Mann-Herzog

- Job : Food Preparation Worker

- Bio : Libero qui animi quia facilis dolorum nesciunt. Distinctio architecto laborum minima voluptas cum minima similique veritatis. Consequatur corporis ex corrupti quas.

Socials

tiktok:

- url : https://tiktok.com/@amalia_xx

- username : amalia_xx

- bio : Dolorem natus sunt delectus asperiores harum voluptas.

- followers : 785

- following : 519

linkedin:

- url : https://linkedin.com/in/amalia.kub

- username : amalia.kub

- bio : Dignissimos perferendis quo illum quam sed non.

- followers : 5893

- following : 952

twitter:

- url : https://twitter.com/akub

- username : akub

- bio : Porro sunt repellendus occaecati et. Architecto expedita fugit architecto ducimus aut ad. Eius autem laboriosam suscipit sit.

- followers : 362

- following : 1175

instagram:

- url : https://instagram.com/amalia.kub

- username : amalia.kub

- bio : Velit id aut ab. Reiciendis quas nihil ipsa magnam cupiditate autem. Similique autem amet saepe.

- followers : 5729

- following : 2297